》Check SMM aluminum product quotes, data, and market analysis

》Subscribe to view historical prices of SMM metal spot cargo

Secondary Aluminum Raw Materials:

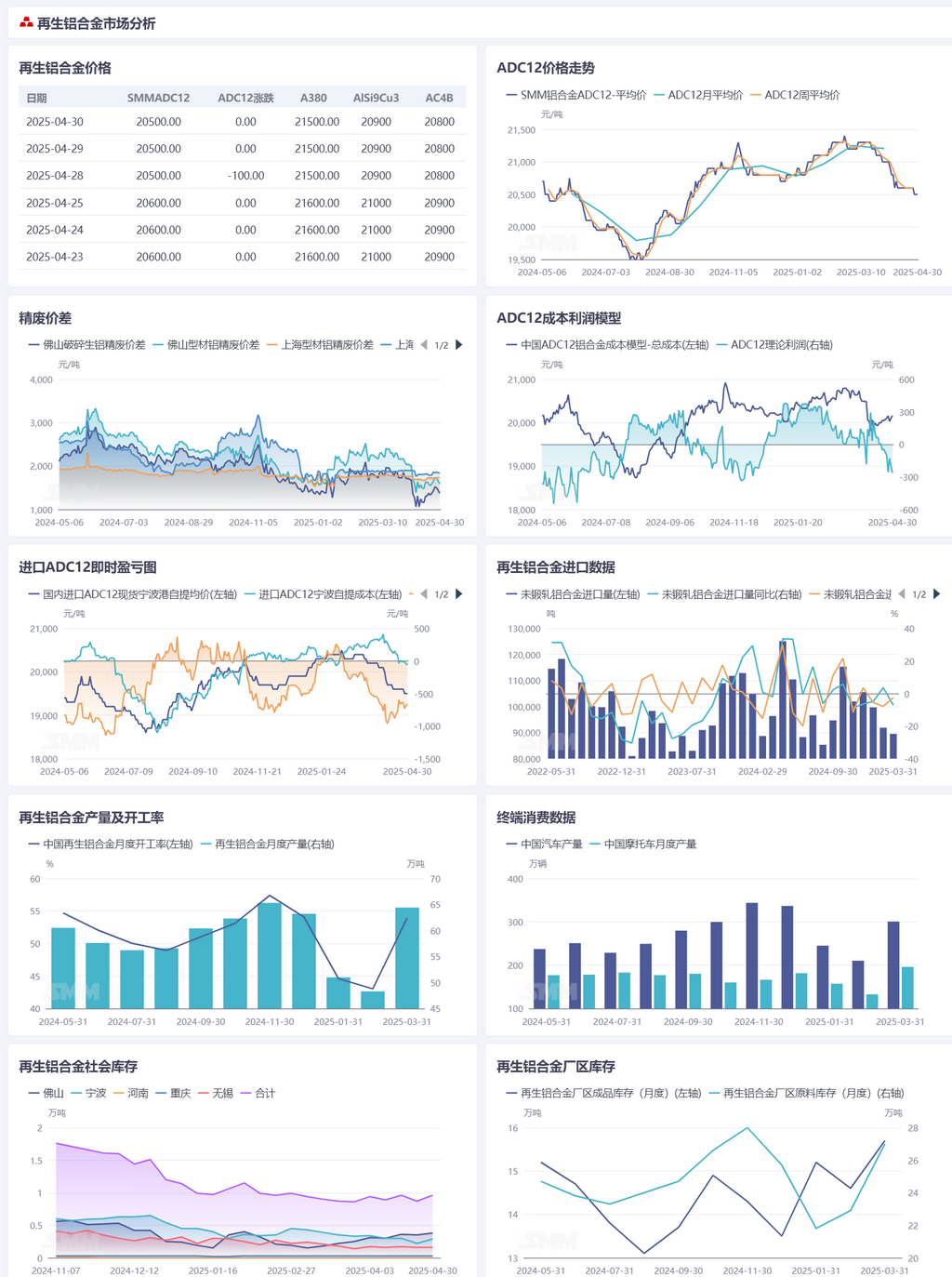

This week, the aluminum scrap market exhibited a pattern of steady differentiation. As of April 30, SMM A00 primary aluminum spot closed at 20,060 yuan/mt, cumulatively rising by 80 yuan/mt from last Thursday. The overall aluminum scrap prices remained stable, but performance varied by grade: low-grade aluminum scrap, such as baled UBC, was supported by a marginal improvement in demand, cumulatively rising by 50 yuan/mt to 15,050-15,650 yuan/mt (tax excluded). Aluminum tense scrap products, due to tight supply, saw shredded aluminum tense scrap prices increase by 100-200 yuan/mt during the week to 15,850-17,350 yuan/mt (tax excluded), maintaining high prices. Regional market differences were significant, with prices in Hunan, Hubei, and South China remaining firm and not fully following the fluctuations of primary aluminum. In contrast, prices in east China and central China closely tracked adjustments in primary aluminum. On the demand side, affected by the tail end of the traditional peak season, downstream processing enterprises experienced weak order releases, with procurement mainly driven by immediate needs. In terms of the price difference between A00 aluminum and aluminum scrap, the price spread for mechanical casting aluminum scrap in Shanghai narrowed to 1,832 yuan/mt during the week, while the spread for mixed aluminum extrusion scrap free of paint in Foshan significantly narrowed by 70 yuan to 1,589 yuan/mt, reflecting increased resistance to price declines in aluminum scrap. Looking ahead after the holiday, the aluminum scrap market is expected to continue fluctuating at highs, with the tight supply situation for aluminum tense scrap products unlikely to change, providing strong price support. Low-grade aluminum scrap such as baled UBC is expected to continue fluctuating rangebound with primary aluminum (±50-100 yuan/mt). Caution should be exercised regarding macro risks: if the US Fed adjusts its policies or geopolitical conflicts escalate, leading to sharp fluctuations in primary aluminum, or if domestic secondary aluminum enterprises collectively cut production, aluminum scrap prices may face periodic pressure. Overall, under the dual weakness of supply and demand in the post-holiday market, the differentiation by grade and regional price spreads may further emerge. It is recommended to closely monitor changes on the supply side and the procurement rhythm of downstream enterprises.

Secondary Aluminum Alloy:

This week, aluminum prices fluctuated rangebound around the 20,000 yuan/mt level, while secondary aluminum alloy prices continued to fluctuate downward. SMM ADC12 prices fell by 100 yuan/mt from last Thursday to the range of 20,400-20,600 yuan/mt. On the cost side, aluminum scrap costs remained relatively stable, but the decline in ADC12 prices exacerbated industry losses. On the demand side, as the Labour Day holiday approached, downstream enterprises generally took holidays, and pre-holiday stockpiling sentiment was low, resulting in poor overall market transactions. In terms of supply, secondary aluminum smelters largely maintained normal production during the holiday or took 2-3 days off, leading to a slight decline in the industry's overall operating rate. In the import market, overseas ADC12 quotes remained at 2,430-2,450 US dollars/mt, with immediate losses for imported ADC12 hovering around 700 yuan/mt. Overall, the current market expectations for May demand are generally weak, and ADC12 prices are expected to maintain a weak consolidation pattern in the short term.